Is cyber security for the banking industry in Ireland something that is a concern for you? If so, you’re not alone. Around 90% of Irish financial firms have experienced business disruption or some financial loss due to cyberattacks in the past five years. In this post, we will detail what the Irish banking system can and should do to increase their cyber resilience.

Cyber Attacks in the Irish Banking System: The Story so Far

Cyberattacks have slowly transformed from secluded disruptions into one of the massive, sophisticated attack scenarios which face Ireland’s financial sector. In the past few years, banks in Ireland and financial bodies have reported an alarming rate of increase in cyber threats frequency and their financial impact on them, which highlights how crucial it is for organisations to strengthen their cybersecurity infrastructure.

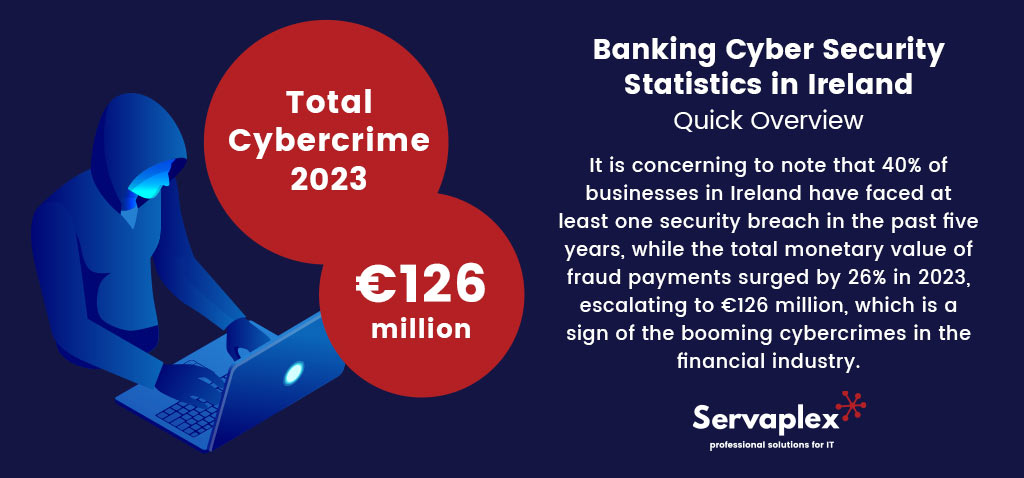

Banking Cyber Security Statistics in Ireland – Quick Overview

Recent insights from Cyber Ireland and the Central Bank of Ireland give a reality check on how deeply embedded these security vulnerabilities are in the country’s banking and financial sector. It is concerning to note that 40% of businesses in Ireland have faced at least one security breach in the past five years, while the total monetary value of fraud payments surged by 26% in 2023, escalating to €126 million, which is a concerning sign of the booming cybercrimes in the financial industry.

For an industry that lays its foundation on trust, the consequences are deep and serious for both the organisations and their customers.

Ireland’s Financial Sector at a Critical Turning Point

The motives behind the cybercrimes have witnessed a dramatic shift over the last few years. In today’s age, attacks such as ransomware and ransom extortion are the key drivers in most attack scenarios, where the primary target is the banking and financial ecosystem of Ireland. This clearly gives a strong signal that there is a precedented transition towards the monetary gains rather than just compromising the system.

The Central Bank of Ireland’s latest study highlights that the total value of fraudulent payments saw a disturbing upward rise to €160 million in 2024, which is a 24.5% surge from the last year. This accentuates the seriousness of the present situation, which needs to be addressed immediately.

Dublin – The Most Targeted Region for Cybersecurity Threats

Dublin, an epicentre of Ireland’s largest group of banks and financial bodies, remains one of the most targeted and popular regions amongst the malicious actors. It is important to note that despite the mentioned statistics, the human defence gap remains a concern. This is highlighted by the fact that only 39% of Irish organisations provided cybersecurity training to their employees last year, while only 43% regularly update their software, a very preliminary step, and yet it is often missed by organisations.

The Shift Toward Proactive Cybersecurity Resilience

Conventional cybersecurity solutions are finding it hard to keep up with the sheer volume and advanced nature of cyberattacks. The banking and fintech bodies are now shifting from the traditional, reactive approach to a smart and proactive security approach. Platforms such as ManageEngine Log360 and ServiceDesk Plus strongly demonstrate this security approach.

Strengthening Banking Operations with ManageEngine Log360

ManageEngine Log360 is a unified SIEM solution equipped with strong capabilities such as UEBA, DLP, CASB, and dark web monitoring. You can reduce breach impact, accelerate the attack investigation, and harden your compliance posture with Log360.

Secure your Banking and Fintech with ServiceDesk Plus

Meanwhile, ServiceDesk Plus empowers financial organisations by centralising incident management, automating workflows, and providing advanced analytics with real-time insights. This allows the banking and financial sector to stay one step ahead of the adversaries in today’s rapidly evolving digital world.

Banking Cybersecurity Specialists

With the right partners and solutions, including Servaplex and ManageEngine, Ireland’s banking and financial industries can harden their cybersecurity ecosystem and adopt a proactive cyber approach against the cyber threats. To arrange a threat diagnostics discussion for your bank or financial institution with our cybersecurity expert, give us a call now on +353-1-2304242 or contact us online, and a member of our team will be in touch.